Home Prices

On a raw (unadjusted) basis, home prices almost always drop in the winter. But on a seasonally-adjusted basis, home prices are still rising, albeit at a slower pace. Let’s call it 3–4% year-over-year.

• Case-Shiller national home price index rose 0.3% month-over-month in October 2024, about the same pace as in September 2024. Year-over-year growth, however, slowed from +3.9% in September 2024 to +3.6% in October 2024. The fastest home price growth was seen in Boston and Washington D.C. (both +0.7% MoM), the slowest in Cleveland (-0.3% MoM) and Tampa (0.1% MoM). [S&P DJI]

• CoreLogic sees even slower price growth. According to CoreLogic’s HPI index, national home prices have basically flatlined since the summer, with year-over-year growth slowing to +3.4% in November 2024. They now forecast +3.8% price growth over the next 12 months. [CoreLogic]

Transaction Activity

There was definitely a bit of pick-up in activity in the last quarter of the year, as falling rates (May-September) and rising inventory improved both choice and affordability. Sadly, that may have come to an end with the recent sharp rise in mortgage rates.

• Existing home sales +4.8% in November. That’s the 2nd month of gains, reflecting lower mortgage rates in Aug/Sep. Home prices declined slightly MoM, but were still up nearly 5% YoY. [NAR]

• Pending home sales rose again. Signed contracts for existing homes rose 2.2% month-over-month in November, the 4th-straight month of rising transaction volume. [NAR]

The Fed & Inflation

With limited progress on inflation lately, and the job market still looking solid, the Fed’s currently in no rush to deliver more ‘accommodative’ rates.

• The Federal Reserve cut rates by another 25 basis points (25 bps = ¼ of a percentage point) in December. That brought the total amount of cuts in this loosening cycle to 100 bps (50 + 25 + 25) so far. [Federal Reserve]

• Federal Reserve’s Open Markets Committee (“FOMC” or “the Fed”) voted to cut the Federal Funds Rate and also signaled a slower pace of rate cuts in 2025. [Federal Reserve]

• The PCE (inflation) came in lower than expected. After a somewhat disappointing CPI release, at least the PCE report (the Fed’s preferred inflation measure) delivered better news, with both “headline” and “core” PCE rising just 0.1% month-over-month in November. [BLS]

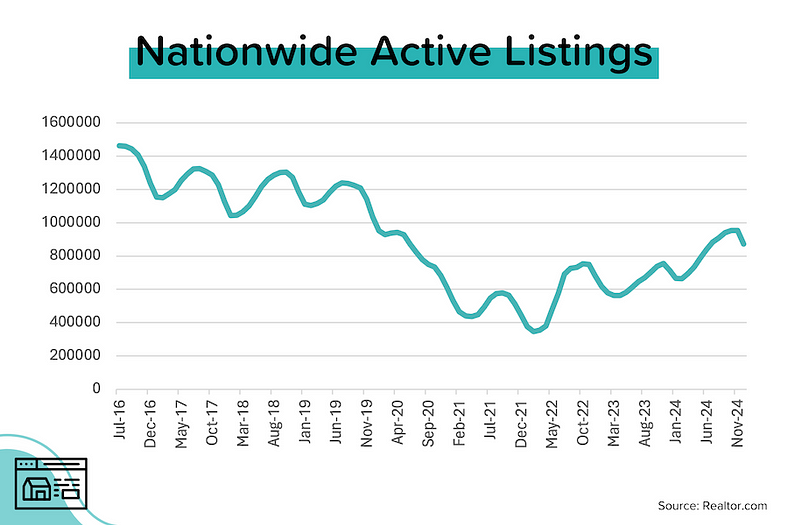

Inventory

Inventory data depends on your time frame and location. At the national level, we’re approaching pre-pandemic numbers of homes for sale. But a lot of that is coming from a few big markets (Florida, Texas). The inventory situation in many Midwestern and Northeastern metros is still very tight.

• Inventory dropped in December. The active inventory of homes for sale fell 9% month-over-month to 871,509 units in December 2024. While this looks like a big drop, it’s actually pretty normal for this time of year. [Realtor.com]